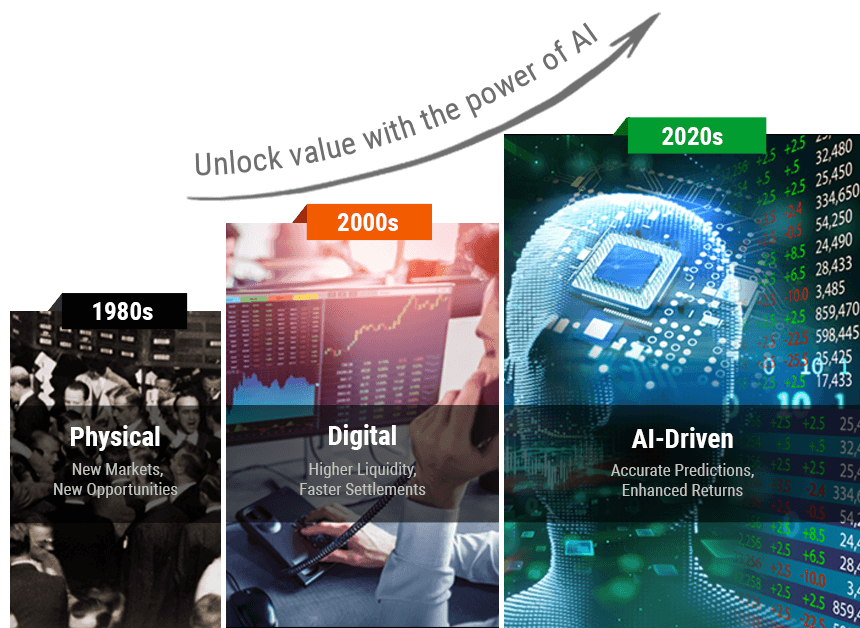

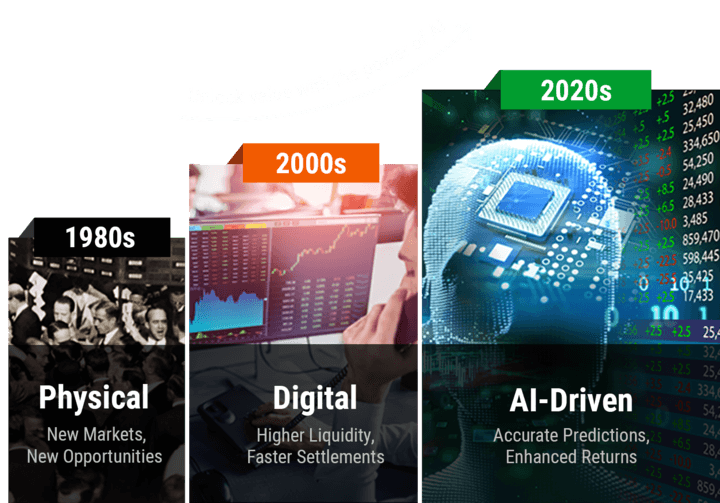

Financial markets have transitioned with technology: starting out as a place of trading, to high-speed online trading for higher liquidity and faster settlements, and now to AI-based algorithmic trading for accurate predictions and higher returns.

The need for AI arises from the fact that financial markets generate the highest data. Traditional online trading and analytics cannot fulfill all the needs of investors. That is why the industry is deploying AI to reduce information asymmetries, boost market stability, provide dynamic, automated, and high intelligence trading and decision making. In India alone, Banking, Financial Services and Insurance is one of the biggest spenders on AI across different use cases (IDC). Nearly 50% of capital markets professionals around the world use AI in their trading processes.

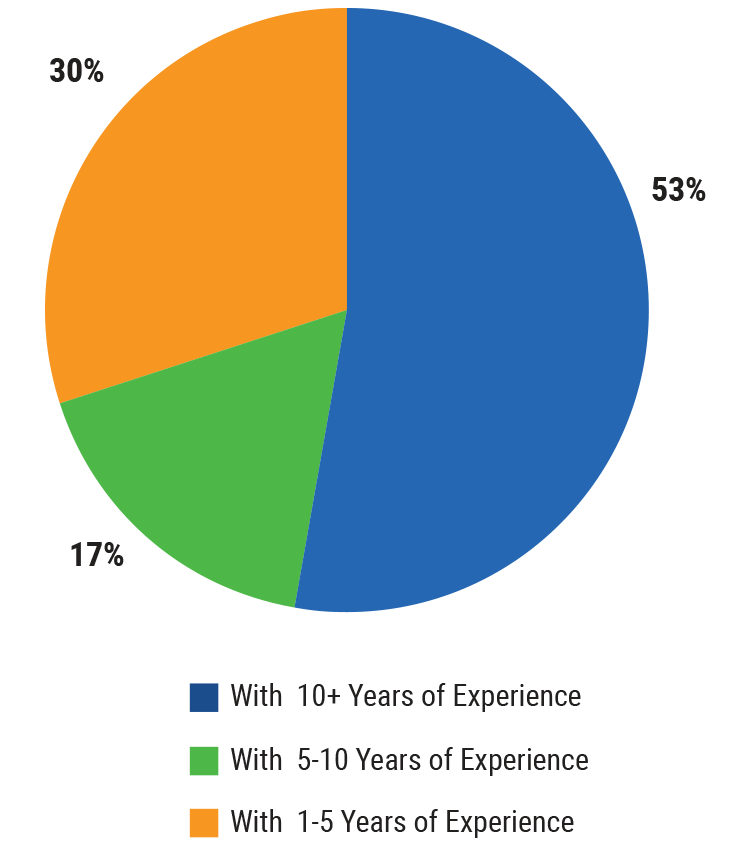

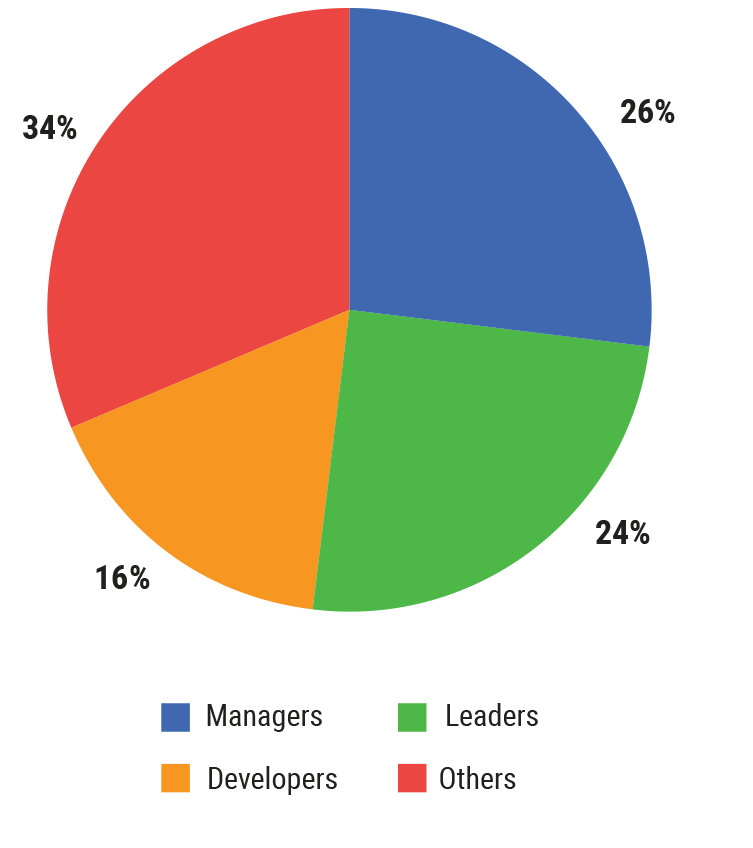

However, lack of AI expertise is often cited as a top challenge for AI deployment in financial markets. Hence there is a need for a program at the intersection of tech and finance to help professionals create AI-driven solutions.

The Advanced Program in AI for Financial Markets has been designed, leveraging the expertise of NSE, India’s Largest Stock Exchange . The program is aimed at financial market professionals keen to unlock the power of AI technologies.

Algorithmic Trading

Algorithmic Trading AI for Risk Monitoring and Mitigation

AI for Risk Monitoring and Mitigation AI-enabled Investment Trust

AI-enabled Investment Trust AI for Client Advisory Services

AI for Client Advisory Services AI for Anti-money Laundering

AI for Anti-money Laundering AI for Trade Flow Analysis and Document Search

AI for Trade Flow Analysis and Document Search AI for Asset Management

AI for Asset Management And many more

And many more

Bridge Module (Essential Math and Programming)**

Bridge Module (Essential Math and Programming)** Introduction to

Introduction to  Fundamentals of

Fundamentals of  Introduction to

Introduction to Unsupervised Learning

Unsupervised Learning Advanced

Advanced  Understanding Market Behavior: Market Microstructure, Behavioral Finance & Derivatives

Understanding Market Behavior: Market Microstructure, Behavioral Finance & Derivatives  Time series and

Time series and  Stock Selection Algorithm

Stock Selection Algorithm  Adjusting Leverage in a Portfolio

Adjusting Leverage in a Portfolio  Smart Portfolio

Smart Portfolio  Stock Price Prediction

Stock Price Prediction  Build Volatility Forecasting Algorithm

Build Volatility Forecasting Algorithm  Automated Stock Trading

Automated Stock Trading  NSE Stock Market Prediction

NSE Stock Market Prediction  Creation of Index

Creation of Index  Robo-advisors

Robo-advisors Risk Monitoring

Risk Monitoring  Forecasting of

Forecasting of

Faculty-led Interactive Masterclass Lectures

Faculty-led Interactive Masterclass Lectures Case Studies and Hands-on Labs

Case Studies and Hands-on Labs Capstone Projects

Capstone Projects Mentor Support

Mentor Support Interactions with Practitioners

Interactions with Practitioners